Dear Unicredit Slovenija Bank and various hidden

onlookers

Picture this. You are in Slovenia. You want to

buy computer bits from Germany for 116,75, using your Unicredit

Slovenija bank account.

How much should you send? The answer, you might

think, is an obvious 116,75. Any fees for sending the money will be

deducted separately from your account.

Wrong. This is Slovenia. The correct answer is

116,75 + guess the amount.

The amount you have to guess is the sum which

will be stolen from your 116,75 en route to your vendor.

But Unicredit don't know anything about this and

it is nothing to do with them. Clear now?

The whole of this story is that on 6 Sep 2023 I

sent 116,75 via SWIFT from Unicredit Slovenija to Best Electronics in

Germany and they only received 106,75. Unicredit eventually admitted in

an email 9 Oct 2023 that 10 was deducted by an "intermediary bank" and

are doing that shrugging thing.

Shrugging (optionally accompanied

by an impatient or helpless look) is a vital part of Slovenian culture and

the endpoint of many confrontations between its innumerable legal utopias and the

gritty reality.

The

first baker's dozen of problems with Unicredit's shrugging argument (see

the email above) are as follows:

1. Unicredit Slovenija is behaving like a slippery eel as usual. Article

214 of applicable law ZPLaSSIED suggests "The

payment system operator shall ensure strength, clarity, transparency and

enforceability of the legal basis of the payment system in all segments

of the

acquis and for all relevant aspects of the activities of this

payment system."

I contend arrival of the right amount of money is a relevant aspect.

2. Unicredit is admitting quite positively that

it only succeeded in sending 91.43% of the payment due.

3. About that transparency and clarity. Having

deducted 116,75 from my account, plus a 42 cent fee, Unicredit never

told me that a payment of 116,75 could not be made.

This was what it contracted to do when it

debited my account. It did not contract to make 106,75 arrive.

It did not contract to get rid of any of the

116,75 or share it out among its different front companies, but to pay

116,75 to the payee.

But Unicredit has sat on its hands and claims

that from the instant my 116,75 departed, it is not even in a position

to know if the transfer to its own sister bank across the Alps did not

succeed as its client(s) intended.

What Unicredit did do was to try to create a

false dichotomy between the money's departure and its arrival, as though

the two were not connected and its obligations ended with the former.

Funniest of all, Unicredit in Ptuj has tried to

pretend recipient bank Hypovereinsbank is a far away thing of which it

knows nothing.

In fact Unicredit got its first big break in

banking

when it bought Hypovereinsbank in 1869 - now Unicredit AG.

About the legal enforceability, Unicredit's

attitude is that an investigation of my missing ten or twenty or more

tens of euros would not be worth the amount involved, and makes us look

bad.

Know what? That's because you are bad.

The great Slovenian shrugging

scenario is key to configuring an end-to-end solution. Why would

Unicredit think or decide I wanted to send 106,75 and not the right

amount? Shrugging.

Where and when were the parties

and particularly the payer informed it was all going wrong? Never.

Shrugging.

Who is this other company you

claim is responsible for the 10 charge? Shrugging.

How come I knew nothing about

this until the goods didn't arrive? What did you do? Shrugging.

For all of the above I got

charged 10,42. Why? Shrugging.

4. So there was a hidden charge. Hidden, we are

meant to believe, not just from the payer, but from Unicredit and the

payee too. But not only this! The

additional 10 to pay it

has been taken from the money expected by the payee.

Slovenians can rejoice, as both non-Slovenian

sellers, and buyers on

foreign markets

where goods can be seven times cheaper than in Slovenia

can be super-inconvenienced by Unicredit's inability

and failure to predict any such deduction. Thanks to Unicredit

Slovenija, no one

knows what's going on. Each thinks the other, or one of their banks, is

trying to rip him off.

Time and money are wasted in a

multiplicative fashion.

The customer is entitled to a noticeable warning

about all the costs in advance.

Instead the banking system has masterfully

combined an unlawfully concealed irregular fee with an added cost for

screwing everything up.

There's a chance of multiplying the event,

turning one transfer into two or three.

But it's not just my 10 that's gone missing, is

it? Surely this must happen to every comparable transaction?

5. It would be manifestly chaotic and

inefficient for Payment Service Providers (PSPs) to unexpectedly deduct

money from every such payment.

By doing so, Unicredit is like an arsonist,

setting fires with every transfer, with everyone blaming each other for

an incomprehensible, annoying and difficult to trace error in the

payment amount.

A myriad problems would be generated requiring,

er, more bank transactions.

6. Oh but it was this other bank - an

intermediary, Unicredit say.

And Unicredit don't know who that is, they say.

But I did not ask Unicredit to send my 116,75

to an intermediary whose whereabouts are unknown.

I did however state on Unicredit's web form that

I wanted it sent to HYVEDEMM448.

7. No prior warning about any intermediary or

its costs, whether foreign or domestic, were apparent during the

transaction.

CSMs don't want to deal with me, nor I with

them.

8. Multiple charges were placed on a single

transaction, which portrayed a cost 25 times lower than the charge

ultimately exacted - for a non-useful result!

No receipt was issued for the charge to the

payer.

9. The cost of the transaction was

misrepresented. 42 cents is bad enough ("It's free if you pay online",

Unicredit purred early on). The cost of the first attempt proved

(according to the bank's belated claim) to be 10,42 plus all the hassle

and confusion of further communications with the bank and between myself

and Best Electronics.

10. So basically Unicredit

Slovenija's plan is to cause hassle and confusion in every single

cross-border transaction involving money going to not-Slovenian people.

Every such payment will arrive

10 short, siphoning off funds to support Hamas or Putin, but actually

probably siphoned straight up the nose of some creep in Ljubljana.

But that is a matter entirely

between Unicredit and him, as my domestic charges have already been supposedly contained by Unicredit Slovenija's outrageous 42 cent fee for

three seconds' computing, and by its statement "Domači

stroki plačniku, tuji stroki prejemniku". As you can see in the

attached screenshot.

11. On the other hand, "Since

this was a transaction in Germany" and since Germany is not part of

Slovenia, it falls under the "foreign" category mentioned here. "Domači

stroki plačniku, tuji stroki prejemniku" it says (again).

As for where the money disappears to, it is

beyond credibility that Unicredit has "no information". Having

information about where money comes from and goes to is why banks exist.

If you want a bank that doesn't have this information, Unicredit

Slovenija is the one for you!

12. If Unicredit did not know "in advance" who

its intermediary was (afterwards), how could it have known where to send

them the money, for them to send to Unicredit's other bank in Rosenheim?

If Unicredit does not know "in advance" who its

intermediary is, how can it know its fee? If Unicredit cannot tell you

its fee "in advance", how will you know how much extra to add to

your payment, to ensure the correct payment will arrive at the other end of

the transfer?

13. Unicredit said it would be 42

cents, that foreign charges were to be met by the payee.

But I was charged nearly 25 times

more, for which Unicredit is having a go at blaming foreigners. Or is

it? We do not know, as Unicredit Slovenija says it does not know through

whom it transferred the 116,75 to Unicredit AG, so the customer

cannot find out if they are foreign or not. So, so transparent.

A systemic ripoff contrary to EU banking principles, defective in

operation, involving discrimination between Member States, and

perpetrated by the contractor Unicredit Slovenija upon the rightfully

suspicious Slovenian banking customer and eurozone dweller, is therefore

exposed.

PART 2

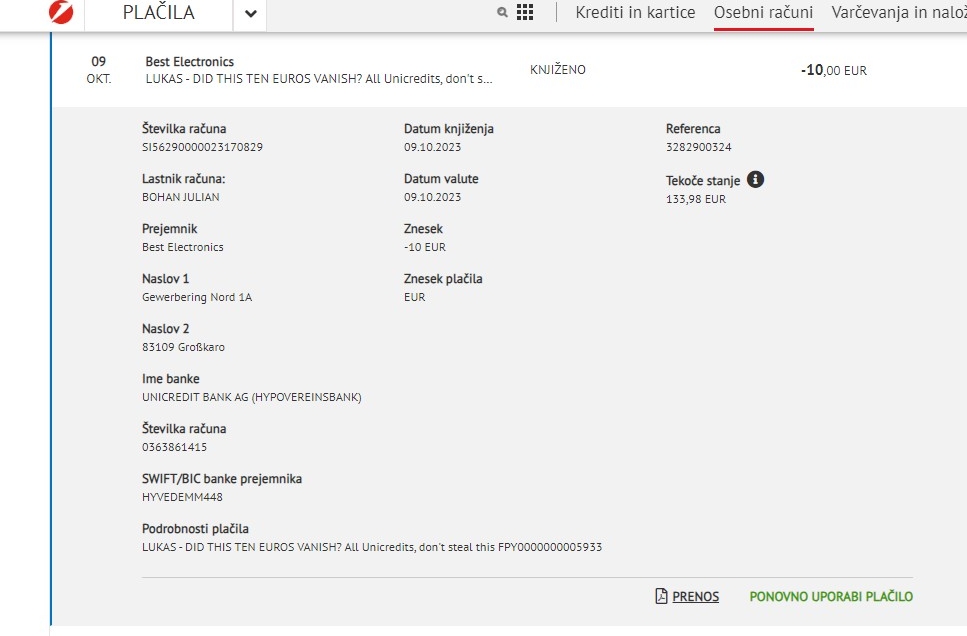

As Unicredit may be able to see, I have now sent

the "unpaid" 10 deducted by this unwelcome intermediary to Best

Electronics. Again.

According to experience, this second

10 should completely

disappear, in the performance of a transfer which, as a consequence of

its architecture, will never take place. I'm enclosing a screenshot of

this second transaction for anyone who's interested.

But on 10 October Best Electronics received my

10, so we can add inconsistency to Unicredit's "charging methodology"

rap sheet.

Meanwhile I am not getting my computers

upgraded, so I'm going to anyone who will listen to reclaim my twenty

euros and compensation for loss of all the computing power I need

to keep up with these self-defeating scams.

First in line is the

Bank of Slovenia complaint service, which like all consumer-facing

assistance in Slovenia looks really helpful, official, and just the

ticket. Until you press "send" and it doesn't work. In this way

the

Slovenian banking industry has automated the shrugging process.

To not warn about a charge is bad enough, but to

just snatch it out of a transaction between two counterparties is a

ludicrously amateurish performance, designed to ruin things. What if I

sent only nine euros?

The dubious idea Unicredit is

floating here is that the outcome of a bank transfer is unpredictable,

and that the intermediary's 10 charge is a "surprise".

And sadly

for the Slovenian bank's shrugtastic theory that all its

responsibilities ended on debit day, a reminder from Directive

2007/64/EC:

"The payer's payment service provider should assume liability for

correct payment execution, including, in particular the full amount of

the payment transaction and execution time, and full responsibility for

any failure by other parties in the payment chain up to the account of

the payee."

Fortunately there is an

organisation overseeing PSPs who have rules to keep things running

smoothly, the way non-Slovenians expect. If the contract to send 116,75

cannot be accurately fulfilled, the transaction should become an

"R-transaction", rather than Unicredit doing a giant smelly dump on

people's attempts to buy and sell stuff.

Says the European Payments Council

"A 'Return' occurs when a credit transfer is

diverted from normal execution after interbank Settlement, and is sent

by the Beneficiary Bank to the Originator Bank for a credit transfer

that cannot be executed for valid reasons such as wrong account number

or account closed with the consequence that the Beneficiary account

cannot be credited on the basis of the information contained in the

original credit transfer message."

Alas if Unicredit knew anything about money, it

would be that money talks. And it mostly says goodbye. A deal to send

1 is a deal to send 1, not 1

or -9.

Therefore I am asking Unicredit to pay

the amount properly.

I am asking Unicredit to ensure the transfer of

the 10 goes through to Best Electronics without any intermediary charge

made without due warning.

I am asking Unicredit to return any 10 I was

not expecting to pay.

I am asking Unicredit to identify the

intermediaries Unicredit Slovenija uses to transfer money to Unicredit

AG, an entity about which Unicredit claims to know nothing.

I am asking Unicredit to

explicitly display all applicable fees on its internet banking such that

the true cost can be evaluated before a transfer.

I'm asking Unicredit to not

contract with CSMs to a situation where fees can be deducted from

payments in transfer to the detriment of the parties, but to try the

sensible and EPC-authorised methodology instead.

As Unicredit will probably be

aware,

"Banks,

companies issuing electronic money, payment institutions and payment

institutions with a waiver based in the Republic of Slovenia must obtain the

appropriate permission

from the Bank of Slovenia to provide payment services in

accordance with the

Banking Act or the

Act on Payment Services, Electronic Money Issuing Services and Payment

Systems. Account

information service providers can provide services after prior registration

with the Bank of Slovenia."

https://www.bsi.si/placila-in-infrastruktura/placilne-storitve-in-elektronski-denar/placilne-storitve

Perhaps

Unicredit can choose retrospectively who its intermediary was, to get into

the best legal position to not give me my 10 back. But I don't see how that

saves Unicredit from Articles 14 (paras. 1-4), 23(1), 23(4(3)), 23(7),

23(9), 23(14), 23(15), 23(16), 23(18), 23(20), 32, 50(1), 50(4(3)), 51(5),

51(9), or 149(1(2)) of ZvPOT-1. Articles

108, 211(3), 221, 228, 237, 240(4), 306 of KZ-1 are interesting, while from Regulation (EU)

No 260/2012 we learn:

"The creation of an integrated market for

electronic payments in euro, with no distinction between national and

cross-border payments is necessary for the proper functioning of the

internal market."

A necessity

in stark contrast to that of this spiv intermediary, be he domestic or

foreign, who has had away with my 10.

Please also

note Article 9 ibid.

This

somewhat destroys Unicredit Slovenija's thinly disguised prejudice against

"foreign" payments. Alas, even the European Payments Council does not seem

to be on Unicredit's side, with

"The

remittance data supplied by the Originator in the Credit Transfer

Instruction must be forwarded in full and without alteration by the

Originator Bank and any intermediary institution and CSM to the Beneficiary

Bank....The

Beneficiary Bank must also deliver received remittance data in full and

without alteration to the Beneficiary."

But

Unicredit did alter and is altering, and did not deliver

and is not delivering the remittance data without alteration to the

Beneficiary.

A

distinction was made between national and

international transfers.

Its pricing

was not legally displayed.

No receipt was issued by the unknown intermediary

to the person footing the bill.

Unicredit

in its contractual relations does not adhere

to the Four Corners Model, and its actions did not, "as

a minimum, cover elements relevant to the execution of a credit transfer".

Their agent did not return

the funds when it failed to find that the Beneficiary account

could not "be

credited on the basis of the information contained in the original credit

transfer message."

In case you are dozing off from all the

shrugging, the information referred to here is my desire to send Best

Electronics 116,75.

See also

their 3.4.

Then

there's Recommendation 5 of the

ERPB working group on transparency for retail payment end-users,

which suggests PSPs:

"Use standards and applications

suitable for including identified data sets 'end-to-end'. Upgrade or change

these standards when necessary."

As SWIFT

sees things, it is ready to "Eliminate payments friction with upfront

account verification":

"Before sending a payment, banks can check the

validity of the beneficiary account by comparing it against our vast library

of transaction data thats over 9 billion payments travelling between 4

billion accounts every single year."

I'm also

liking

"It is essential, for the fully integrated straight-through processing of

payments and for legal certainty with respect to the fulfilment of any

underlying obligation between payment service users, that the full amount

transferred by the payer should be credited to the account of the payee.

Accordingly, it should not be possible for any of the intermediaries

involved in the execution of payment transactions to make deductions from

the amount transferred."

And who

could forget

"It should be possible for the payment service provider to specify

unambiguously the information required to execute a payment order

correctly."

While

intermediaries should

"Be transparent to the Scheme and in no way affect or modify the obligations

of the Participants."

Twice is not

an accident or coincidence, and so in the

interests of the transparency

recommended by Article 4 of 260/2012, when

Unicredit finds

out who its business partner is for transferring money to Germany, I am

asking it to also

reveal to which

of the above categories (i) to (viii) this

sepulchral entity belongs.

It looks

like Unicredit's fine will be limited to

125,000 under Article 318

supra. Per instance, I hope. There's no need to worry, as in my case it can

just lend itself

125,000 and then not pay itself back.

I hereby grant the

recipients of this email the right to examine all data they might consider

not examining using data protection as an excuse.

Instead of seeing customers, and particularly

international ones, as cows to be milked, Unicredit would do well to explain

why they are so good at sneaky tricks, but not competent enough investors to

pay decent interest rates or operate a predictable payment service. For

these prices I'd expect a luxury service, not these lies and this

shrug-show.

Presently, Unicredit's assertions are not worth

the pixels they are printed on! As it may rely

on XI 7 of its

T&C, I shall rely on the obligations it does have, as enumerated above,

which taken together appear sufficient to prosecute ex officio.

XI 2, as you can see,

rests on

regulation

binding the intermediary or third person involved,

which includes of course the Four Corners Model, showing payers and payees

have no interaction with Clearing and Settlement Mechanisms, and therefore

cannot be billed by them - with or without a warning on Day D or an invoice

afterwards. And certainly not out of the transfer itself. And y'know:

"...it is essential that the processing of

credit transfers and direct debits is not hindered by business rules or

technical obstacles such as compulsory adherence to more than one system for

settling cross-border payments."

Which I will

argue outranks

Unicredit's claims of a right to irresponsibility.

Meanwhile

at other banks, the EU was frequently mentioned in the context of cheap

transfers with no intermediaries, with Delavska Hranilnica offering to wire

116,75 to Best Electronics' bank for 2,30 all in, and swanky bank NLB

coming in at 5, rising to 9 for non-EU Switzerland, still cheaper than

Unicredit for EU euro transfers - even for non-customers.

For the

edification of fellow victims these emails are published at

www.aaa.si/unicredible

Lep Pozdrav

Julian Bohan

PART 3

To the Minister of Finance, 12 October 2023

Dear Klemen

Dealing with the problem of banks shrugging about money being

stolen from customers in irregular banking practices in Slovenia, I

was drawn to the seemingly helpful site of the Bank of Slovenia, which

invited me to send it a complaint.

I was pleasantly surprised, as Slovenia comes across as a very

anti-complaint culture.

I did so, but

https://vsebina.bsi.si/PUFS

wouldn't send. So I emailed the complaint to pr@bsi.si instead

and asked for a reference number.

Unfortunately, and due perhaps to the failed automation or

shrugging, the Bank of Slovenia has not got back to me.

Being ignored doesn't facilitate the complaint process, and I

wonder if they are genuine.

It's starting to look like they are anti-complaint after all. No

complaint can officially exist without a number, and there is not much

point to a complaint with no response. So by the sheer power of

inactivity the Bank of Slovenia is implying we have no complaints.

My feeling is that the Bank of Slovenia may have only expressed

an interest in banking complaints to meet some EU diktat requiring them

to be complaint compliant.

Of course the EU inspector of complaint-compliance would not

actually have a complaint and would never fill in or try to send the

form.

So they would never find out that the Bank of Slovenia's

professed interest in our complaints is a sham.

And if it can't get the computing right for a complaint form,

what are its chances with counting money and so on?

Perhaps it worked once, and this can all be traced back to the

discovery in some office, when it broke, that life was a lot easier

after that.

Please encourage them to make the anti-complaint complaints

system accept and respond to complaints, and to send me the complaint

number for mine, which you can see at

www.aaa.si/unicredible.

Thank you for your attention to this matter.

LP

Julian Bohan

PART 4

Notes on online dispute resolution.

Notes on data protection.

CONCLUSIONS (BASED ON RESPONSES SO FAR)

Every hour, thousands in unearned fees are generated in Slovenia by

shrugging. The victims are those who cannot be bothered to argue the

toss.

The power of shrugging ensures Slovenia's banking economy is carried on

the shoulders of angry-customer-facing personnel, with shrugging

contributions from lawyers and consumer protection services, all the way

up to the highly trained professional shrugs of policemen, financial

inspectors, data protection officials, ombudsmen, and political

operators.

Experience suggests one shrug at the branch level is worth ~2 euros,

with ~5 shrugs required to steal 10. But the value per shrug to the

bankers will steadily diminish if further layers of shrugging are added

during the dispute phase, even as sunk cost error and -

paradoxically - the profit motive encourage ever harder shrugging.

The SWIFT system is being abused. And shrugging in Slovenia is key to

this.

Charges for transfers between Unicredit and Unicredit are not taking

place as lawfully intended, requiring remedial transactions.

Customers are being charged for no reason, for something Unicredit has

no problem doing for 42 cents, and for which the costs are substantially

the same, when the payee is in Slovenia.

It is hard to get Slovenians to join the War on Shrugs, as shrugging is

part of a culture of treating people like downtrodden suckers.

In this it is easier for the victims to acquiesce to discrimination

against themselves, as it is considered socially embarrassing to

kick up a stink.

Those who choose to focus on the "type" of complainants, or reply with

accusations that these are degrading Slovenian business, its regulation,

or Slovenia generally, are simply seeking to distract from the

substantive issue of Unicredit stealing their money.

As such they are complicit in their own (generalised) reputation.

Without shrugging, the economy would have to work according to European

and national laws suggesting that bank customers should not be charged

10 for a SWIFT transfer, or differently than for national transfers -

and not charged at all by intermediaries - except by prior agreement and

fair warning.

Neither are part of Unicredit's plan which its staff don't know it has.

To avoid simple checks of its own data, Unicredit has chosen to insert

an unknown extra company or companies, creating an unnecessary layer of

bureaucracy, slowness, data protection risk, inefficiency, and cost, in

order to generate this charge. For reasons unknown to themselves, to

regulators, to their service users, or to you.

Perhaps these reasons will become clear when we find out who and what

the intermediaries and their relationships are.

But there is a lot of shrugging to be done before that can happen.

Those shrugging that a pathetic

10 is not worth bothering about are reminded of the many far more

essential items they buy priced at less than 10.

Those in finance who are still not convinced, who think 10 is nothing,

and are still shrugging about it, are invited to

send me their own 10.

It might arrive.

RESOLUTION OF THE RECEIPT OF THE COMPLAINT

18 October 2023

Dear Mr. Bohan,

thank you for your email. We are sorry that you had problems with our

new channel for complaints. We would like to explain that we have

successfully received several complaints and you are the first reporting

to us with this kind of problem. We will look into it.

Notwithstanding the above, we can confirm receiving your complaint via

email. It is under the review with our professional services and we will

get back to you as soon as possible.

Kind regards,

BANKA SLOVENIJE Evrosistem | E: pr@bsi.si

PART 5

LEGAL CHAFF: THE CUSTOMER IS ALWAYS WRONG

2 November 2023

Dear Mr. Bohan Julian,

In the Complaints Monitoring Department, we received your email in which

you requested an explanation for the foreign payment made on 9th October

2023, in the amount of EUR 10, to the recipient Best Electronics. We

appreciate your message and below is our response:

UniCredit Banka Slovenija d.d. (hereinafter referred to as the Bank)

executed the foreign payment in the full amount of EUR 10. Additionally,

an outbound commission fee of EUR 0.42 was subsequently applied, in

accordance with the Bank's tariff.

Again, this was a transaction to Germany, but in this case, our foreign

payment made a manual correction of the payment order, so the transfer

was not carried out through intermediary bank, which would again

deducted EUR 10 for order execution as in the first case, when you made

the foreign payment on 6th September 2023 in the amount of EUR 116.75.

We kindly ask you that in case, you will be making another payment order

to Germany, enter the IBAN number of receiver and not routing number.

Best regards,

UniCredit Banka Slovenija d.d.

Customer Contact Center and Support

Complaints Monitoring

2 November 2023

Dear Unicredit

Thank you for your email, which has been added to www.aaa.si/unicredible

for reference purposes.

Having never even heard of routing numbers until today, I am however

accustomed to using IBAN numbers and SWIFT numbers. I recall your internet

banking likes to have both.

Intrigued by your squirming, I turned to the internet. "Routing numbers are

used only on US accounts," says https://moneytransfers.com/iban/iban-vs-routing-number.

Maybe that explains why I've never heard of routing numbers. In my

simpleminded way, I would expect Slovenian internet banking to refuse to

accept a number for a transfer to Germany that is not used in Europe.

If what you say is correct, why didn't it refuse to accept it?

Do you mean the SWIFT number? They are not the same thing. Unfortunately for

your attempt to rectify events in your favour by heaping unannounced

responsibilities upon the customer, "Germany has an 8-digit routing

code", according to Wikipedia.

So is moneytransfers.com wrong?

Where on the transfer application is the 8-digit number to which you refer?

I attach a screenshot of a recent payment where an IBAN was used, but no

IBAN appears in the record of any such payment. This makes your response

suspiciously convenient. But legally, it doesn't make any difference to

your position.

The fee was deducted out of the transfer, contrary to the abovementioned

regulatory requirements of https://www.europeanpaymentscouncil.eu/sites/default/files/KB/files/item%201%20EPC125-05%20SCT%20RB%20v7.2%20approved.pdf

and https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2012:094:0022:0037:en:PDF

and https://eur-lex.europa.eu/legal-content/en/ALL/?uri=CELEX%3A32007L0064 and

the Four Corners Model.

The complaint remains unresolved.

There was no warning of a fee in advance for

allegedly not providing Best Electronics' IBAN, which is DE

96 7112 0077 0363 8614 15, and no

receipt was issued, per the aforementioned Slovenian statute ZvPOT-1.

Also you do not mention that transfers accompanied by the instruction

"All Unicredits, do not steal this" are exempt from the fee (see

foregoing).

As you know, if you personally drop ten euros you don't forget about it and

leave it on the ground. Perhaps you have a personal minimum for which you do

not consider it worth bending over. Here, you attempt to make valid a charge

made lacking warning or a receipt, by placing fault with the customer.

But here Slovenia's empathy is

revealed in all its typical non-existence.

The customer would not choose a method designed to cost him more -

whether the entity issuing the bill is Slovenian or foreign. Yet you are

implying I did.

Speaking of which, who are they, and which is it? And where is this secret

intermediary registered - America?

Basically the customer should not be able to make a mistake. If,

due the faulty design of your system, I did (which I dispute) it's still

Unicredit's fault, whether the ten euros has been misappropriated by

accident or design.

You can fool some of the people all of the time, and you can fool all of the

people some of the time. But you can't fool all of the people all of the

time. Perhaps it is time to ban non-Slovenian customers, since you find

foreign things so distinctly and institutionally troubling. If you think

getting my name backwards adds to your credibility for accuracy, think

again.

Which number do you call a routing number?

Where's my ten euros?

LP

Julian Bohan

PART 6

A COMMON WAY OF DOING BUSINESS

The Ptuj State Prosecutor on 3 March 2025 replied that the deduction was due

to "shared costs, which means that the sender, when making the transfer to

abroad pays the costs of the remittance to its bank, while the recipient

receives the remittance, reduced by the costs of the receiving bank," and

that "This is a common way of doing business in international transfers of

money."

Completely wrong, for all the reasons which this page explains. Some kind of

middle-class visual impairment seems to be at work for, as has already been

pointed out to the Prosecutor, the bank said:

Don't even try to suggest that the foreign bank is the payee: Best

Electronics is the payee. The Prosecutor seems to agree that the ten euros

was deducted by Unicredit in Germany, and that this kind of theft is

"common" - both of which admissions represent some kind of incremental

progress towards reality I suppose.

My reply to the Ptuj Prosecutor of 4 March 2024:

Spotovani,

e enkrat vas opozarjam na naslednjo vsebino s plačilne strani banke.

Poleg tega protokoli, opisani na spletni strani www.aaa.si/unicredible,

jasno izključujejo odbitke pri nakazilih. Pravilno ravnanje v primeru,

da nakazila ni bilo mogoče dokončati, kot je nameraval plačnik, bi bilo,

da bi ga v celoti zavrnil. Točk od 1 do 13 ali dela 2 na spletni strani

www.aaa.si.si/unicredible sploh ne obravnavate.

Banka Slovenije kljub temu, da je dajala videz, da jo pritoba zanima,

in jo je na koncu tudi priznala, ni nikoli zaključila nobenega postopka

ali se dodatno odzvala, in sicer iz razlogov, ki naj bi bili tipičen

potemkinizem.

It says:

Once again I draw your attention to the following content from the bank's

payment page. Besides which the protocols described at

www.aaa.si/unicredible clearly preclude deductions from transfers. The

correct action, in the event that the transfer could not be completed as

intended by the payer, would have been to reject it in its entirety. You

don't address points 1 to 13 or Part 2 at www.aaa.si.si/unicredible at all.

Despite making it look like they were interested in, and eventually

acknowledging, the complaint, Bank of Slovenia never concluded any process

or responded further, for reasons expected to be typical Potemkinism.

For the latest ex officio action see here.

.jpg)